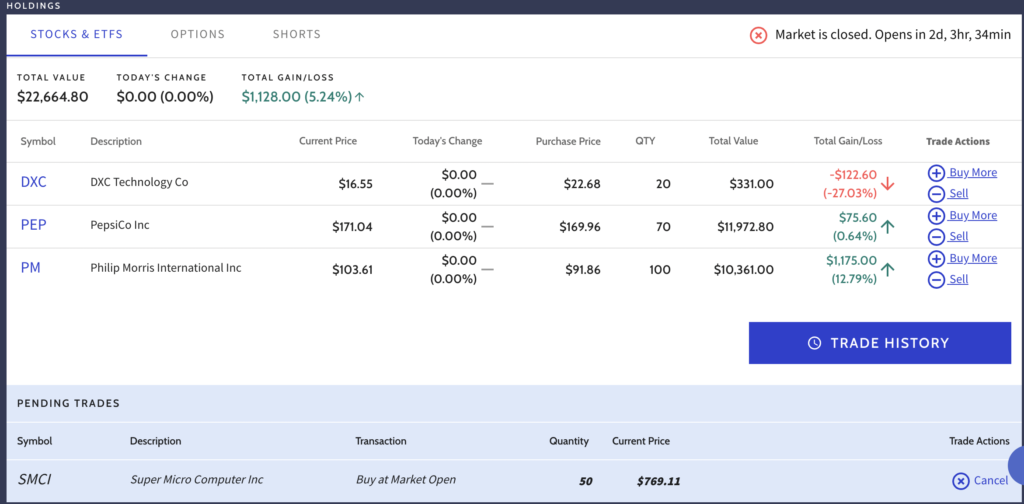

Phillip Morris (PM)

Phillip Morris likely saw an increase in stock price due to positive investor sentiment and strong financial performance in the tobacco industry. As a leading cigarette manufacturer, PM benefits from the addictive nature of its products and consistent demand. Additionally, the company’s pricing power allows it to raise prices and maintain profitability despite declining smoking rates.

PepsiCo (PEP)

PepsiCo’s stock price increase can be attributed to the company’s diversified product portfolio, including popular snack and beverage brands. PepsiCo has a strong market presence and pricing power, allowing it to pass on higher costs to consumers. The company’s consistent financial performance and shareholder-friendly policies like dividends and share buybacks also contribute to positive investor sentiment.

Stock That Went Down

DXC Technology (DXC)

DXC Technology’s stock likely declined due to concerns about the company’s financial performance and competitive position in the IT services industry. The company has faced challenges in recent years, including restructuring efforts and the loss of major contracts. Investors may have lost confidence in DXC’s ability to adapt to changing market conditions and compete effectively against larger rivals.Additionally, the broader technology sector has faced headwinds recently, which could have negatively impacted sentiment towards DXC and other tech stocks. Factors like rising interest rates, economic uncertainty, and concerns about future growth prospects may have contributed to selling pressure on DXC’s shares.In summary, the stocks that went up (PM and PEP) benefited from positive investor sentiment, strong brand recognition, and consistent financial performance in their respective industries. On the other hand, DXC Technology’s stock declined likely due to company-specific challenges, competitive pressures, and broader market concerns impacting the technology sector.

I am also choosing to invest on SMCI